Embarking on the journey of stock picking is an exciting venture for many beginners, offering a path to potentially substantial financial growth and investment savvy. However, without the right knowledge or approach, this journey can quickly become overwhelming. Stock picking involves selecting individual stocks for investment with the goal of achieving a diversified and profitable portfolio. This process requires a keen understanding of the market, the ability to analyze financial statements, and an insight into company operations and industry trends. The essence of this guide is to shed light on the fundamental principles and strategies that can help novice investors navigate the complexities of the stock market confidently. By focusing on key areas such as diversification, thorough research, and risk management, this guide aims to demystify the process and set beginners on a path to successful investing.

1. Understanding Diversification

Diversification stands as a cornerstone strategy for minimizing risk in your investment portfolio. The core principle behind diversification is not putting all your eggs in one basket. Instead, it involves spreading your investments across a wide range of sectors, industries, and asset classes to safeguard against the volatility of the market and the potential downturn of any single investment. For those focusing on stocks, diversification can be achieved by investing in a mix of companies from different sectors such as technology, healthcare, consumer goods, and energy, as well as varying the investment across small-, mid-, and large-cap stocks. This approach helps in reducing the risk of significant losses if one sector or company underperforms.

Additionally, mutual funds and exchange-traded funds (ETFs) are highlighted as effective vehicles for achieving broad diversification with less effort and complexity. These funds aggregate stocks from numerous companies, sometimes spanning across multiple industries, offering an instant diversified portfolio. For beginners, investing in mutual funds or ETFs can be a simpler way to achieve diversification without the need to meticulously select and manage a large number of individual stocks.

2. Conducting Thorough Company Research

Before taking the leap into stock investment, it’s paramount to embark on comprehensive research about the company in question. This step is about peeling back the layers to understand the financial health, industry performance, and any recent developments that could influence the company’s stock price. A solid starting point is to dive into the company’s financial filings, which offer a treasure trove of information on its financial performance and strategic direction. These documents, including balance sheets, income statements, and cash flow statements, are typically available in the Investor Relations section of the company’s website.

Market news sites and deep analysis platforms serve as vital resources for staying abreast of current events and sector trends that might impact the stock. Additionally, becoming acquainted with financial ratios, notably the price-to-earnings (P/E) ratio, provides invaluable insights into the stock’s valuation and the company’s profitability compared to its peers. This ratio helps in evaluating whether a stock is overvalued, undervalued, or fairly priced based on its current earnings.

3. Evaluating Stock Value and Performance

Evaluating a stock’s value and performance involves a critical examination of its financial health and how its current market valuation stacks up against historical norms. Key metrics like the P/E ratio and dividend yield come into play here, offering snapshots of the company’s profitability and the efficiency of your potential investment. The P/E ratio, for instance, compares the company’s share price to its earnings per share, providing a gauge of the market’s valuation of every dollar of the company’s earnings. A stock with a P/E ratio lower than its historical average might indicate a good buying opportunity, assuming other factors remain constant.

The dividend yield, which measures the dividend relative to the stock’s current price, offers insights into the stock’s income-generating potential. A higher-than-average yield might suggest the stock is undervalued, though it’s crucial to consider this in the context of the company’s overall financial health and market conditions. These assessments help investors discern whether a stock is likely to deliver value in line with their investment goals, ensuring decisions are based not just on intuition but on solid financial analysis.

4. Learning Risk Management

Risk management is a fundamental aspect of the stock-picking process, underlining the importance of aligning investment choices with one’s personal risk tolerance and investment horizon. It’s essential for investors to introspect and understand their comfort with risk—whether they are inclined towards high-growth, high-risk stocks for potential greater returns or prefer more stable, conservative investments for lower risk exposure. This understanding influences the selection of stocks, as long-term investors might have the leeway to ride out the volatility associated with higher-growth stocks, whereas short-term investors, aiming for more immediate goals, may find safer bets more appealing. Balancing the potential returns against the levels of risk you’re comfortable with is crucial, as it guides the construction of a portfolio that reflects your financial goals and risk tolerance.

5. Leveraging Tools and Resources

In today’s digital age, numerous tools and resources are available at investors’ fingertips, significantly enhancing the stock selection process. Brokerage platforms, for instance, offer an array of free tools such as stock screeners, research materials, and access to analyst ratings, which can greatly aid investors in making well-informed decisions. These tools allow investors to filter stocks based on specific criteria, access in-depth analysis and insights, and stay updated on market trends and news. Moreover, keeping abreast of broader market movements and developments within sectors of interest becomes much more manageable with these resources. Leveraging these tools effectively can simplify the investment research process and help you make more educated choices in selecting stocks.

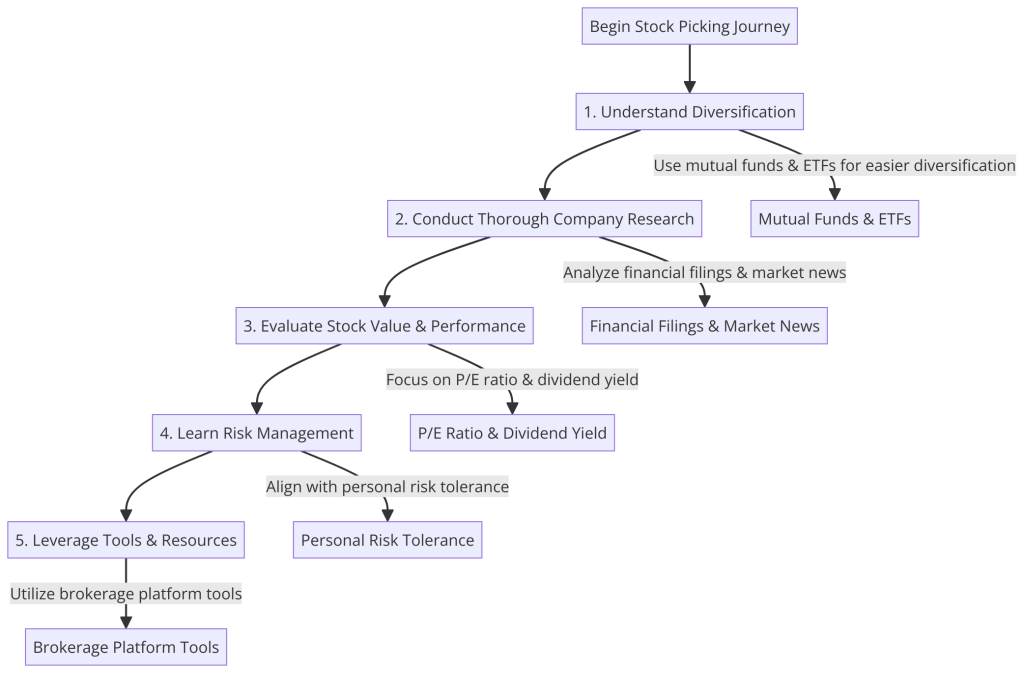

Structuring Success in Stock Picking for Beginners

For many venturing into the investment world, the path to stock picking can appear daunting. Yet, with a structured approach and the right tools, navigating the complexities of the stock market becomes an achievable endeavor. Our diagram, “The Structured Path to Stock Picking,” lays out a step-by-step guide designed to equip beginners with the necessary insights for informed investment decisions.

The journey begins with understanding the crucial role of diversification in minimizing risk. By spreading investments across various sectors and asset classes, newcomers can safeguard their portfolio against significant market downturns. The next crucial step involves conducting thorough research into potential investment targets, delving into company financials and industry trends to unearth valuable insights.

Evaluating stock value and performance through critical financial metrics such as the P/E ratio and dividend yield helps in identifying stocks that offer promising value. Learning about risk management, and aligning investment choices with one’s personal risk tolerance, ensures that investors are prepared for market volatilities.

Lastly, leveraging the wealth of tools and resources available through brokerage platforms empowers investors to filter stocks based on specific criteria, access in-depth analyses, and stay abreast of market developments. This structured path, highlighted in our diagram, serves as a roadmap for beginners, guiding them towards successful stock picking and a diversified, profitable investment portfolio.

In Conclusion

Navigating the complexities of stock picking can be made simpler with a well-rounded approach that emphasizes thorough research, strategic diversification, and diligent risk management. For beginners, understanding these foundational principles is paramount in building a successful investment strategy that aligns with personal financial goals and risk preferences. By conducting comprehensive company research, evaluating stock value and performance, understanding and managing investment risk, and leveraging available tools and resources, novice investors can enhance their ability to select stocks that contribute positively to their investment portfolio. Embracing these strategies can set the foundation for a rewarding investment journey, marked by informed decision-making and strategic planning.

Cassandra Toroian is a sports-tech entrepreneur and CEO/co-founder of Ruley, the AI “e-referee” serving tennis, pickleball, padel, golf, and soccer. With 25+ years building companies—and a background in finance (MBA) plus Python training—she’s also co-founder of Volleybird and author of Don’t Buy the Bull. A former Division I tennis player, she’s focused on using AI to make sport fairer and more accessible.