The journey to financial growth is both exciting and daunting, especially for those just starting out. The world of investing, with its myriad of options and strategies, can often seem like a labyrinth to newcomers. However, the key to unlocking its potential lies in simplifying the investment process. This guide is designed with the beginner in mind, aiming to cut through the complexity of the financial market by highlighting top stocks and services that offer clear, actionable advice. The goal is to empower new investors, enabling them to make well-informed decisions that align with their financial goals. By focusing on reputable stock advisory services and a selection of promising stocks, we intend to demystify investing, making it more accessible and less intimidating for those eager to start their journey towards financial growth.

Understanding What Stock Advisory Services Offer

For beginners, navigating the stock market can feel like sailing uncharted waters. This is where stock advisory services become an indispensable compass. These services provide more than just stock recommendations; they offer a gateway to market insights, comprehensive research, and expert analysis that can help identify potential winners in the market. By leveraging advanced technology and the expertise of seasoned analysts, stock advisory services deliver data-driven insights that are crucial for informed investment decisions. Whether it’s understanding the fundamentals that drive stock performance, getting timely updates on market trends, or learning about strategic investment approaches, these services equip investors with the knowledge and tools necessary to succeed in the stock market. For anyone looking to enhance their wealth through investing, tapping into the resources offered by stock advisory services is an essential step in building a solid foundation for financial success.

Highlighting Recommended Stocks for Beginners

Apple Inc. (AAPL)

Apple has long been a staple for investors looking for steady growth. Its innovation in technology, combined with a fiercely loyal customer base and a broad ecosystem of products and services, makes it a compelling choice for beginners. Apple’s financial health and its role in leading technological advancements contribute to its potential for sustained growth, making it a solid entry point into the stock market.

Spotify (SPOT)

As a leader in audio streaming and a significant player in the audiobook market, Spotify represents an exciting growth opportunity. The company’s expansion into podcasts and partnerships with content creators highlight its commitment to dominating the audio space. For investors interested in the tech and entertainment sectors, Spotify offers a chance to invest in a company at the forefront of changing how we consume media.

Teladoc Health (TDOC)

Teladoc Health stands out as a pioneer in the telehealth industry, a sector that has seen rapid expansion, particularly in the wake of global health concerns. With an increasing shift towards virtual healthcare, Teladoc’s services are more relevant than ever, offering investors an opportunity to tap into the future of medicine and healthcare delivery.

Tesla (TSLA)

Tesla’s impact on the electric vehicle (EV) market and its role in advancing sustainable energy solutions have made it one of the most watched stocks in recent years. Under the leadership of Elon Musk, Tesla continues to innovate, not just in EVs but also in battery technology and renewable energy products, positioning it for potentially significant growth as the world moves towards greener solutions.

UnitedHealth Group Inc. (UNH)

UnitedHealth, as one of the largest healthcare companies, offers a diversified portfolio in healthcare services and insurance. Its investment in technology and data analytics to improve healthcare delivery and patient outcomes makes it a robust stock for those looking to invest in the healthcare industry’s growth and innovation.

How to Start Investing with Little Money

The barrier to entry for investing has significantly lowered thanks to technological advancements and regulatory changes. Commission-free trading platforms and the availability of fractional shares allow individuals to start investing with small amounts of money. Here’s how beginners can start:

- Employer’s Retirement Plan: For those employed with access to a 401(k) or similar retirement plan, contributing even a small percentage of your salary can be a great start. Many employers offer matching contributions, which can instantly double your investment.

- Individual Brokerage Accounts: Setting up an account with online brokerages that offer low or no minimum deposit requirements can be another excellent way for beginners to start investing. These platforms often provide educational resources to help make informed decisions.

By leveraging these entry points into the stock market, beginners with limited funds can begin their investment journey, taking the first steps towards building long-term wealth.

Laying the Foundations for Investment Success

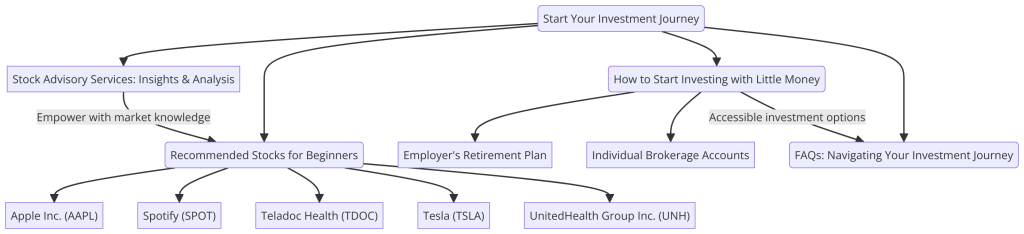

The journey into the world of investments can seem fraught with complexity and overwhelming choices, particularly for newcomers. However, the pathway to financial empowerment and growth can be significantly demystified and simplified through structured guidance and the right tools. Our diagram, “Laying the Foundations for Investment Success,” illustrates a beginner-friendly roadmap designed to navigate the multifaceted world of stock investing.

Commencing this journey requires understanding the value brought by stock advisory services, which serve as a compass in the vast sea of investment opportunities. These services offer crucial insights, analysis, and data-driven recommendations that help beginners make informed decisions.

Central to this pathway are recommended stocks for novices, such as Apple, Spotify, Teladoc Health, Tesla, and UnitedHealth Group. Each represents a unique sector or innovation trend, promising both learning opportunities and potential financial growth.

The diagram further guides beginners on how to start investing with little to no money, highlighting accessible entry points such as employer retirement plans and individual brokerage accounts. These avenues offer a practical starting point for early investors, allowing them to dip their toes into the market without significant upfront capital.

Addressing common questions and concerns, the “FAQs: Navigating Your Investment Journey” segment provides answers and advice on leveraging financial websites for education, taking the first steps in personal finance, and effectively utilizing online tools and resources.

“Laying the Foundations for Investment Success” is not merely a diagram but a comprehensive strategy, offering clarity and direction to those embarking on their investment journey. By following this structured approach, beginners can confidently step into the world of investments, armed with knowledge, strategies, and tools essential for navigating the stock market’s complexities.

FAQs: Navigating Your Investment Journey

How do I start using financial websites to learn about investing?

Begin by exploring reputable financial websites that offer beginner-friendly content. Many of these sites provide guides, glossaries of financial terms, and articles on basic investment concepts. Start with the basics to build a solid foundation of knowledge, and gradually delve into more complex topics as you become comfortable.

What are the first steps to learning personal finance?

The first step is to assess your current financial situation, including income, expenses, debts, and savings. Use financial websites to learn budgeting techniques, understand the importance of an emergency fund, and get acquainted with different types of investment vehicles. Setting clear financial goals and a budget is crucial for personal finance success.

How can I effectively use tools and resources provided by financial websites?

Leverage tools like budget calculators, investment simulators, and risk assessment quizzes to gain insights into your financial health and investment style. Subscribe to newsletters, follow financial news and analyses, and participate in community forums to stay informed and engage with other investors.In conclusion, the stocks and services highlighted in this guide provide an excellent starting point for beginners embarking on their investment journey. Through the effective use of reputable stock advisory services and financial platforms, new investors are equipped with the knowledge and tools necessary to confidently enter the stock market. These resources simplify the investment process, offering clear, actionable advice that demystifies complex financial concepts. By committing to lifelong learning and leveraging these insights, beginners can lay a strong foundation for financial growth and stability, paving the way toward achieving their financial goals and securing their economic future.

Cassandra Toroian is a sports-tech entrepreneur and CEO/co-founder of Ruley, the AI “e-referee” serving tennis, pickleball, padel, golf, and soccer. With 25+ years building companies—and a background in finance (MBA) plus Python training—she’s also co-founder of Volleybird and author of Don’t Buy the Bull. A former Division I tennis player, she’s focused on using AI to make sport fairer and more accessible.